Reporting Profits on a Tax Year Basis

Starting with the Self-Assessment return due by 31 January 2025, all sole trader and partnership businesses must report their profits on a tax year basis. What is the Basis Period Reform? The Basis Period Reform represents a major change in how self-employed individuals and partnerships calculate their taxable profits. Previously, the basis period was tied […]

The Importance of Evaluating Business Processes

In the digital age, business processes are the backbone of organisational operations, ensuring tasks are completed efficiently and effectively. These structured sequences of digital tasks enable businesses to achieve their goals, streamline operations, and maintain competitiveness. However, it is crucial for organisations to periodically pause and scrutinise their processes. Simply taking the time to stop […]

HMRC New Tool for Voluntary National Insurance Contributions

In the UK, the National Insurance (NI) system serves as a fundamental pillar of the welfare state, providing financial support and services to individuals throughout their lives. National Insurance Contributions (NICs) require mandatory payments made by most employees, employers, and self-employed individuals to fund state benefits, including the State Pension, statutory sick pay, and unemployment […]

Employers: Getting Ready for Tax Year end 2023/24 and Welcoming the New Tax Year 2024/25

As the end of another tax year approaches, it’s essential for employers to ensure they’re prepared for the transition from tax year 2023/24 to 2024/25. This article provides a comprehensive guide to help employers understand and comply with the necessary procedures. Ensuring Accuracy and Compliance for Tax Year End 2023/24: Employee Information Verification It’s crucial […]

Rising Companies House Fees

As of 1 May 2024, businesses across the United Kingdom are set to face a significant change in their operational costs with the implementation of rising Companies House fees. This adjustment, while seemingly subtle on the surface, carries weighty implications for companies of all sizes. Navigating the Increase On 19th February 2024, Companies House declared […]

Challenge Completed! Scott Lees Completes 7in7 Challenge For MNDA

NR Barton’s Senior Tax Manager completes his Christmas challenge of walking 7 marathons in 7 days over the Christmas break. Scott has been raising money for Motor Neurone Disease Association (MNDA). Scott set out to raise £777 for MNDA, he did not imagine that he would be close to raising £10,000 for a great cause. […]

SEISS Fourth Grant – Am I Eligible & How Much Can I Claim?

If you are self-employed and your business has been negatively impacted by the covid-19 pandemic, you could be eligible for the fourth grant of the Self-Employment Income Support Scheme. To make your claim for the fourth grant, you must do so on or before 1 June 2021. This grant will cover the period […]

Are You & Your Business Ready For Brexit?

The UK has left the EU and there are now only 10 days remaining before we will be forced to face new rules for business with the EU. Additionally, we will also be forced to face a range of different protocols, especially when planning to travel abroad. These may include renewing your passport, taking out […]

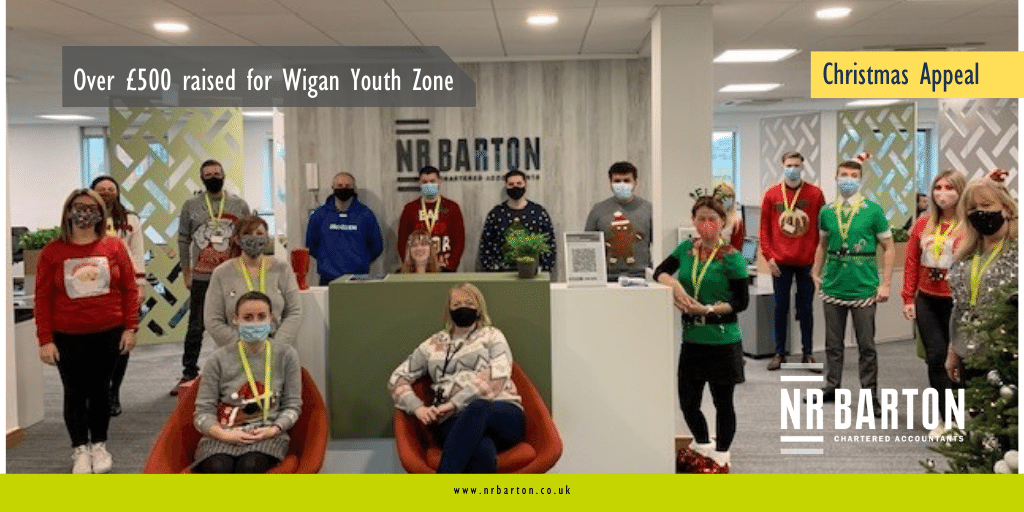

NR Barton Team Raise Over £500 For Wigan Youth Zone

Every year, a charity very close to our hearts (Wigan Youth Zone), makes a donation of perishable food and other domestic products to over 80 families across the Wigan borough. The restrictions imposed by Coronavirus have resulted in donations being slow so far this year. However, although things are different, the Christmas Festivities must still […]